- หน้าหลัก

- >

- 43.4% Year-On-Year Growth in Australia’s Early-Stage Construction Projects

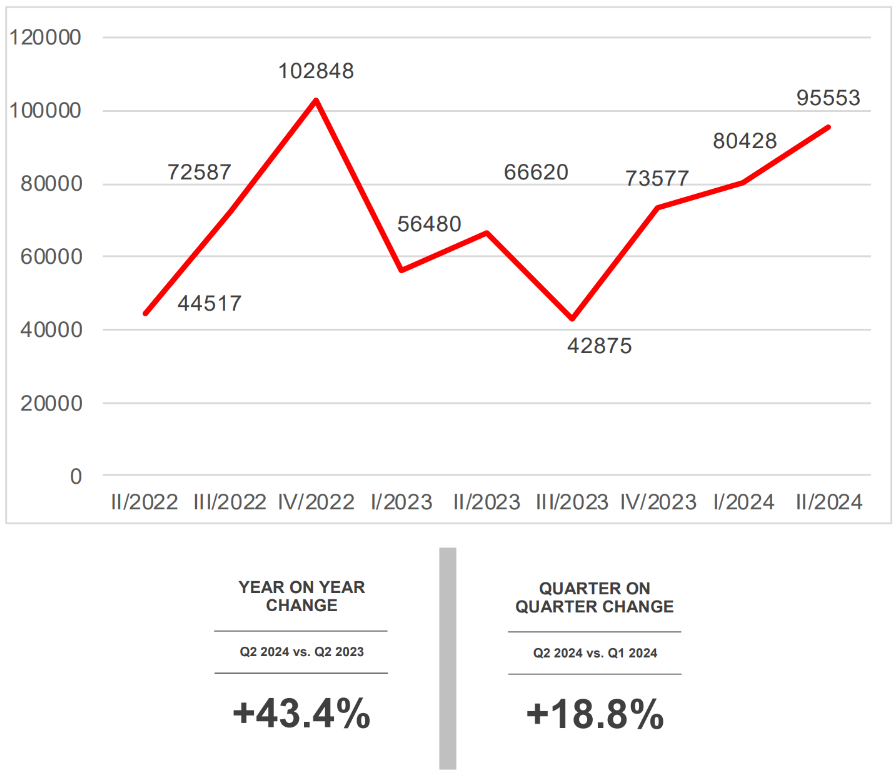

43.4% Year-On-Year Growth in Australia’s Early-Stage Construction Projects

Australia – August 2024 – BCI Central, a leading provider of market intelligence for the construction sector, is excited to announce the release of its Q2 2024 Pipeline Report for Australia.

The BCI Pipeline Report is a quarterly publication that delivers leading indicators on the value of new construction projects in their early stages, from concept to design and documentation. Currently reporting on over 130,000 active projects across Australia, New Zealand, and Southeast Asia, BCI’s series of Pipeline reports present a clear picture of trends and opportunities at both regional and category levels.

The report examines early-stage construction activity across Australia, categorised into building projects such as residential, community (including recreation, legal, and health), education, office, industrial, and retail & hospitality, as well as civil projects encompassing infrastructure, transport, and utilities.

Total Projects in Australia

The Australian economy experienced modest growth in Q1 2024, with a 0.1% quarterly and 1.1% annual increase. While consumption rose, investment declines tempered overall economic performance. The Reserve Bank of Australia’s cash rate remains steady at 4.35%, aiming to control inflation.

Despite weak economic conditions, Q2 2024 early-stage projects rose 43.4% year-on-year and 18.8% quarter-on-quarter. The civil sector, boosted by utilities, led growth. NSW & ACT topped project value, while VIC had the most early-stage projects. The community sector ranked second in project numbers after the civil sector.

Sector Analysis

The Q2 2024 analysis of various project sectors reveals significant growth in residential, office, education and industrial projects despite overall weak economic conditions.

Residential projects surged 43.5% year-on-year and 53.9% quarter-on-quarter, indicating a robust housing market. Office projects experienced an extraordinary rise, with a 214.2% year-on-year and a 71.8% quarter-on-quarter increase, reflecting improving demand for commercial space.

Industrial projects saw a massive 250.2% year-on-year growth but dipped 6.0% quarter-on-quarter, suggesting recent stabilisation. Retail and hospitality projects grew steadily, with a 37.4% year-on-year and a 10.5% quarter-on-quarter rise. However, community projects lagged, decreasing by 0.5% year-on-year and 38.0% quarter-on-quarter, highlighting potential challenges in public sector investments.

BCI Central ANZ Research Manager Sarah Murphy said the Australian construction sector remains resilient despite inflation, high interest rates, and labour shortages, with a notable increase in early-stage projects.

“The civil sector leads with renewable and energy-related projects, advancing Australia’s goal of net zero emissions by 2050,” Murphy said.

“Residential projects gain momentum as federal and state governments tackle affordable housing shortages and release land for new developments.”

“New data centre proposals are boosting early-stage office projects, with significant growth expected in the sector due to increasing digital technology reliance.”

Total Projects in Australia ($MN)

Key Highlights

- Robust Growth in Civil Projects: The civil sector has shown remarkable growth, with a 28.3% year-on-year increase and a 30.2% quarter-on-quarter rise in project value. Utilities projects dominate this sector, contributing over 90% of the total value.

- Overall Market Trends: Despite economic challenges, the construction sector in Australia demonstrates resilience as seen through the project proposals / investments that are being planned. Both building and civil projects have outperformed previous periods, with NSW & ACT leading in project value proposals, followed by QLD and VIC.

- Sector Analysis: The residential sector shows promising growth, while the industrial sector, though coming off a peak, remains strong with high-value projects. The community sector and office projects also contribute significantly to the market dynamics.

- Headline Project: The civil category leads this edition with utilities projects comprising over 90% of the sector. The 2.2 GW Kut-Wut Brataualung Offshore Wind Farm near Gippsland, VIC, valued at AUS$10 billion, is in early planning and aims to support clean energy goals while creating thousands of jobs. Key components include wind turbines and grid connections.

Looking for more insights into new projects in Australia? Get in touch today to learn more about our BCI Pipeline Report Australia Q2 2024 and early-stage project data in the building (residential, community, education, office, industrial, retail, and hospitality) and civil (infrastructure, transport, utilities) sectors.

Information utilised in the BCI Pipeline Report Australia Q2 2024 is current as of 1 July 2024.