- หน้าหลัก

- >

- NZ Construction Pipeline Contracts Amid Economic Pressures, But Key Opportunities Emerge

NZ Construction Pipeline Contracts Amid Economic Pressures, But Key Opportunities Emerge

New Zealand – August 2024 – BCI Central, a leading provider of market intelligence for the construction sector, is excited to announce the release of its Q2 2024 Pipeline Report for New Zealand.

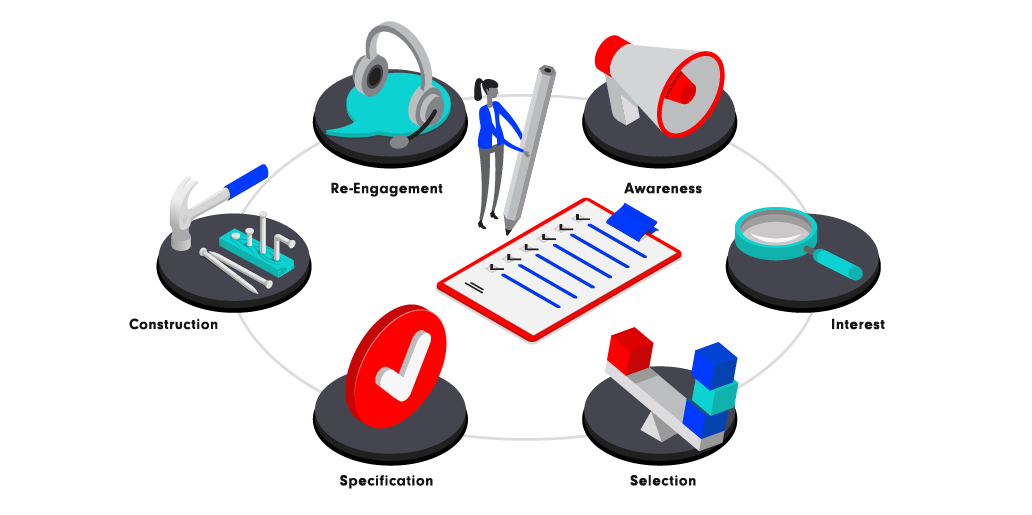

The BCI Pipeline Report is a quarterly publication that delivers leading indicators on the value of new construction projects in their early stages, from concept to design and documentation. Currently reporting on over 130,000 active projects across New Zealand, Australia, and Southeast Asia, BCI’s series of Pipeline reports present a clear picture of trends and opportunities at both regional and category levels.

The report focuses on regional construction activity across three main areas: the Upper North Island, Lower North Island, and South Island, and categories projects by sector, including residential, community, education, office, industrial, retail & hospitality, and civil.

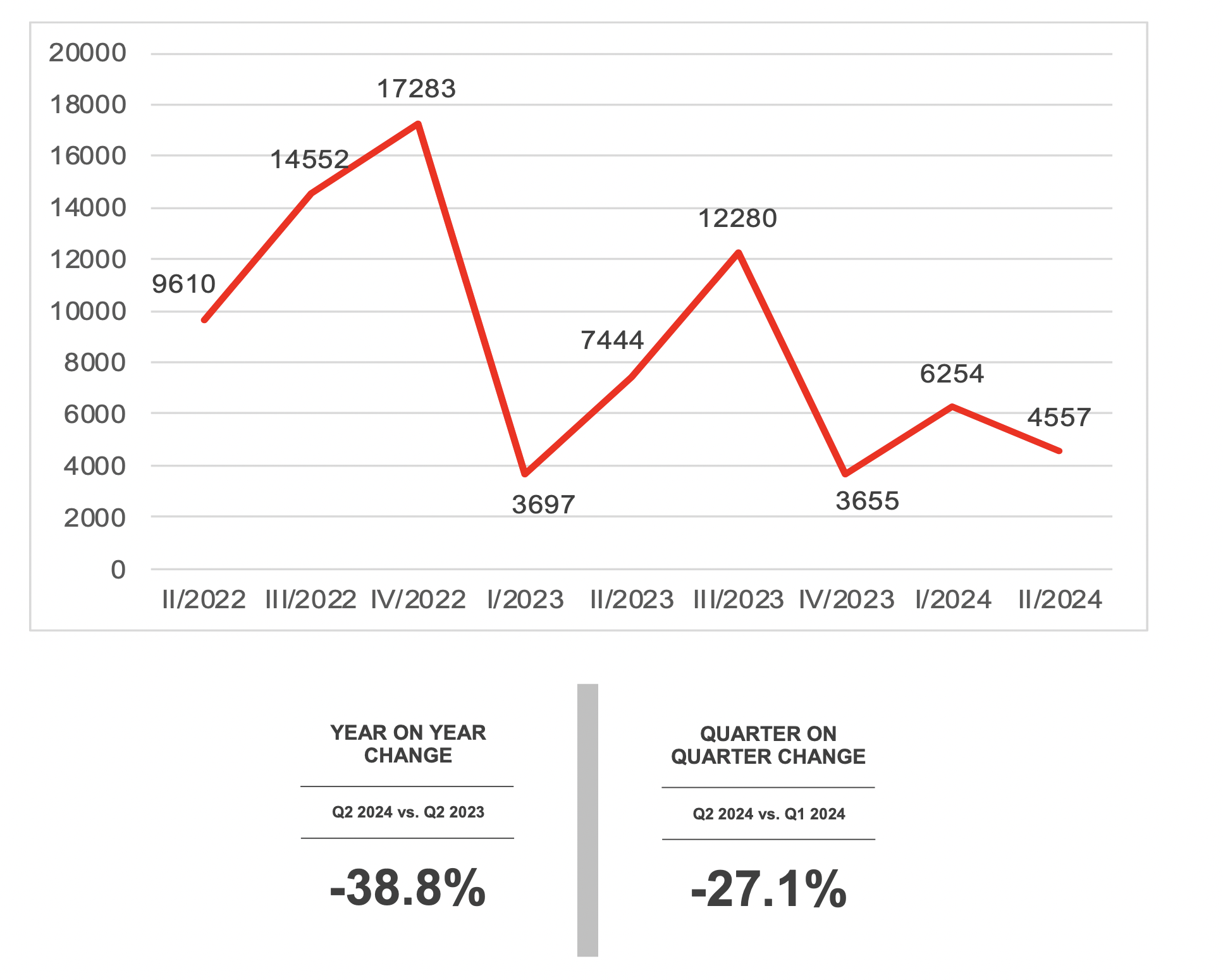

Total Projects in New Zealand

New Zealand’s economy grew by 0.2% in Q1, with one of the drivers a 0.9% rise in rental and real estate services. Construction fell by 3.1%, while building consents edged up 0.5%. The cash rate stayed at 5.5%, with inflation still high, affecting confidence.

In Q2 2024, early-stage projects in New Zealand fell by 38.8% year-on-year and 27.1% quarter-on-quarter. Amid ongoing economic challenges, no rebound such as that of Q4 2022 has been seen. The Upper North Island (UNI) provided the most gains but still didn’t push the total into positive territory, while the Lower North Island (LNI) and South Island (SI) lag.

Sector Analysis

Sector performance reveals a mixed picture, with the community, education and office sectors being positive in the short term, while civil and residential are the leading contributors in terms of the value. The residential sector, despite a 29% year-on-year drop and a 13.5% quarter-on-quarter decrease, features significant projects like the NZ$150 million Summerset Mosgiel and NZ$100 million Mount Albert apartment development.

The office sector saw a dramatic 52.3% year-on-year decline but rebounded with a 691.7% increase quarter-on-quarter, buoyed by developments such as the NZ$100 million Auckland Central office project. The industrial sector continues to struggle with a 76.1% year-on-year and 89.2% quarter-on-quarter drop.

Retail projects have fallen by 58% year-on-year and 51.2% quarter-on-quarter, reflecting ongoing challenges. In contrast, the community sector, despite a 75.5% year-on-year decrease, experienced an 87.9% quarter-on-quarter increase, driven by projects like the NZ$300 million Three Parks – Roa Hospital in Wanaka.

BCI Central ANZ Research Manager Sarah Murphy said the New Zealand construction sector is cooling off from its post-Covid highs, with fewer early-stage projects in the pipeline.

“Although labour shortages have eased, supply chain issues, high interest rates, and inflation continue to pressure the industry,” Murphy said.

“The civil sector leads in early-stage projects, particularly energy-related utilities that push NZ toward its zero-emissions target. Despite a decline in residential construction, opportunities remain as the NZ Government and community housing providers advance public housing plans and urban developments.

“Construction professionals can find optimism in recent amendments to the Building Act, which increase design flexibility and allow product substitutions to lower costs and reduce delays.”

Total Projects in New Zealand ($MN)

Key Highlights

- Promising Prospects in the Residential Sector: Despite economic challenges and a declining residential sector, the industry remains a top contributor to total values. Key projects like the NZ$150 million Summerset Mosgiel and the NZ$100 million Mount Albert apartments highlight ongoing high demand and sustained investment.

- Regional Contributions to Project Value: The total value of early-stage projects in New Zealand fell by 38.8% year-on-year and 27.1% quarter-on-quarter. The Upper North Island continues to lead in project value, contributing significantly despite the overall decline.

- Diverse Growth Across Sectors: The residential sector, which contributes around 68% to total building, showed a 29% year-on-year decrease and a 13.5% quarter-on-quarter drop. The community sector had an 87.9% quarter-on-quarter increase but a 75.5% year-on-year decrease. Office projects saw a significant 691.7% quarter-on-quarter rise.

- Headline Project of the Quarter: The Kaipara Waste to Energy Plant in Northland, valued at NZ$730 million, is the standout project this quarter. This 72 MW green energy project will contribute significantly to the national grid and the local economy.

Looking for more insights into new projects in New Zealand? Get in touch today to learn more about our BCI Pipeline Report New Zealand Q2 2024 and early-stage project data in the building (residential, community, education, office, industrial, retail, and hospitality) and civil (infrastructure, transport, utilities) sectors.

Information utilised in the BCI Pipeline Report New Zealand Q2 2024 is current as of 1 July 2024.