- Home

- >

- BCI Forecaster Report: Australia (October 2021 – December 2021)

BCI Forecaster Report: Australia (October 2021 – December 2021)

Information utilised in this report is current as of 1 October 2021.

About

The BCI Forecaster is a leading monthly indicator of construction contract values hitting the market in the upcoming three months. Construction start values are presented Australia-wide, broken down by civil and building construction as well as by five key states and six key building sectors/project categories.

The short-term forecast is illustrated by contrasting the immediate three-month outlook against the previous three months. The longer-term trend is shown by contrasting the value of twelve months’ construction starts, ending three months out, against the corresponding 12-month period a year earlier.

The BCI Forecaster is an indispensable short-term planning tool, allowing decision makers to set realistic goals and parameters for their sales and operations teams.

Data is based on projects reported on a daily basis by BCI Central’s real-time project leads database, LeadManager.

Snapshot

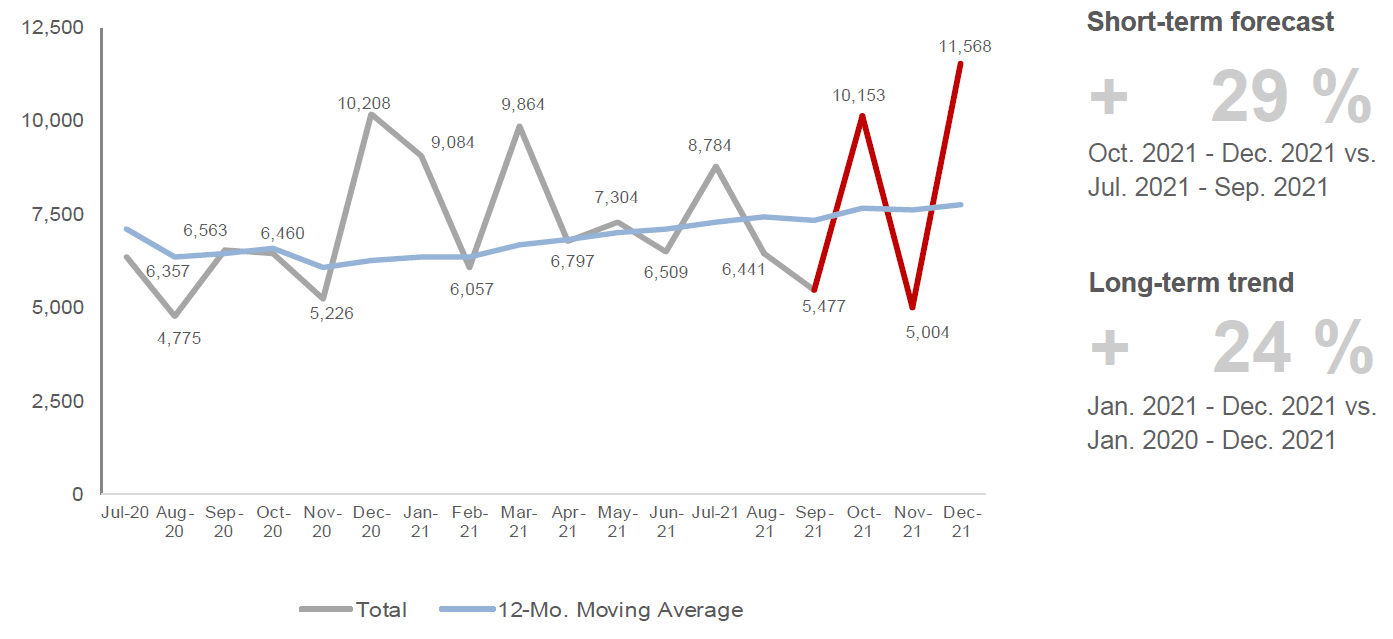

TOTAL CONSTRUCTION STARTS IN AUSTRALIA (MILLION $)

Outlook

After months in lockdown, some restrictions are expected to be eased in Victoria as the state hits the 80 percent first dose vaccination mark. Despite this, the state is still grappling with the surge of Covid-19 infections, sending some areas into lockdown anew. Protests over mandatory vaccination for construction workers and concerns about transmission in the industry led to the closing of construction sites for two weeks.

Meanwhile, plans to lift restrictions in Sydney may take place early in October once vaccination targets are achieved. In this developing situation, there are near-term fluctuations in construction start values, including the fall in the previous September estimate. However, the 12-MMA trend remains to be slowly and steadily climbing.

Building Sector

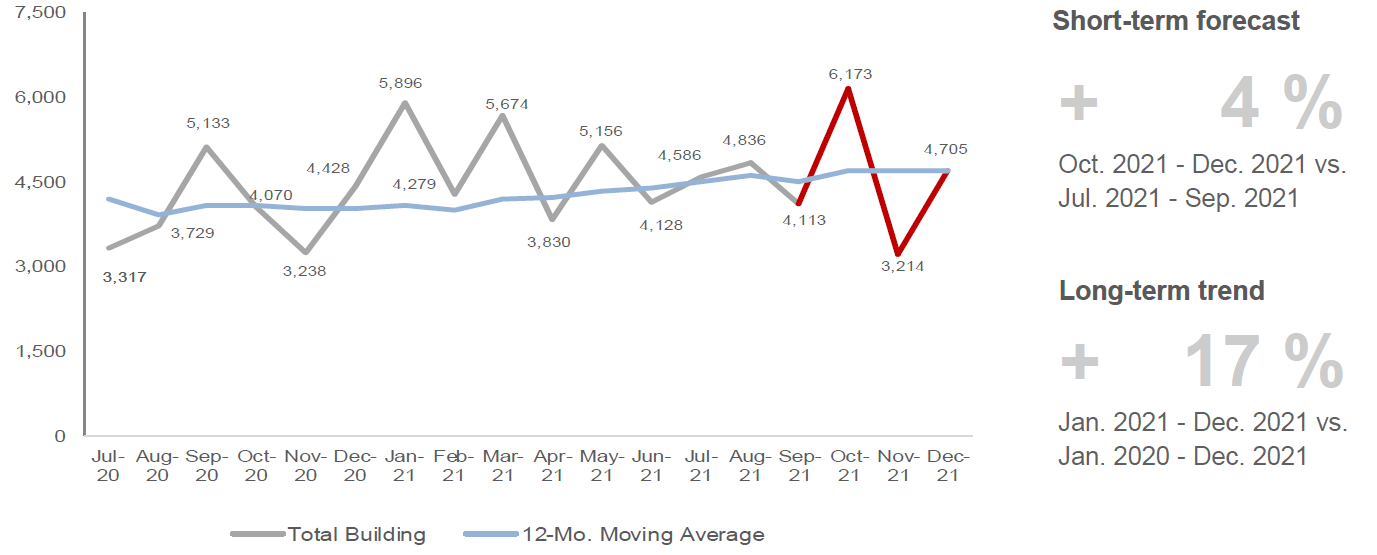

TOTAL BUILDING CONSTRUCTION STARTS IN AUSTRALIA (MILLION $)

Building sector commencements are seen to strengthen in the coming quarter, relative to the last edition, thanks to project starts slated for October and December. Residential developments are seen to fall in the short-term. Although favourable borrowing conditions are seen to be sustained for a longer period, the economic uncertainty as well as constraints on the construction industry are at play.

The community category is breaking the lull with major health projects such as The Canberra Hospital Expansion (Formerly Spire) (PID 137567017) valued at around AU$500 million, the AU$740 million Liverpool Hospital Redevelopment (PID 216031017), and the WA Quarantine Facility – Centre for National Resilience (PID 239352017) with a total approximate project value of AU$400 million.

While the education and office sectors continue to drop, the retail and hospitality sector is increasing in momentum.

Civil Sector

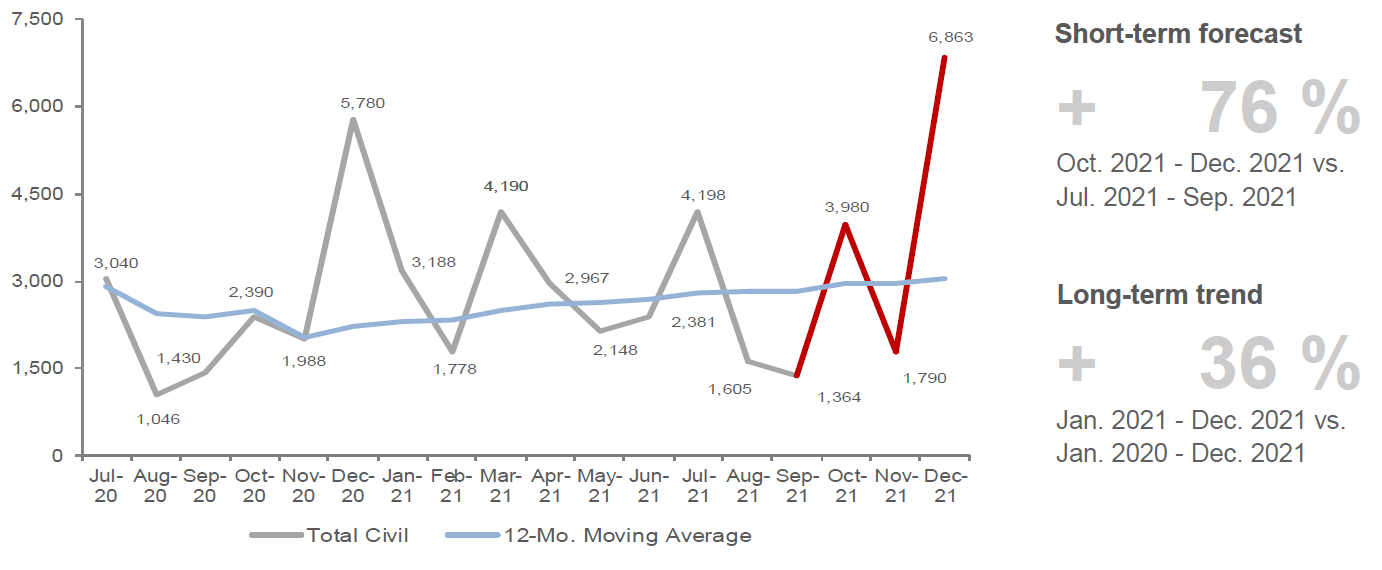

TOTAL CIVIL CONSTRUCTION STARTS IN AUSTRALIA (MILLION $)

The continuous growth in public investments shows the boost in spending for civil developments by national, state and local governments. The pace continues to pick up in the civil sector where prospects are seen across infrastructure, transport, and utilities projects.

We report the preparations for the Sydney Metro West TSE Works Package 1 (PID 256709017) in Sydney, and the commencing of early works for the Gold Coast Light Rail Stage 3 (PID 192138017) under the transport segment. The Sydney Gateway Road Project – Stages 1 & 3 (PID 177647017), covering several road networks such as the Qantas Drive upgrade and extension, and the Copperstring 2.0 (PID 18244017), are progressing further.