- Home

- >

- BCI Pipeline Report: Australia (Q1 2022)

BCI Pipeline Report: Australia (Q1 2022)

Information utilised in this report is current as of 1 April 2022.

Download your copy of the BCI Pipeline Report here.

About

The BCI Pipeline Report provides quarterly leading indicators of the value of new construction projects in their early stages (from competition to documentation). It is an essential source of construction information for any organisation or individual connected or concerned with the future of the construction industry in Australia.

The BCI Pipeline Report offers more than just a general view of the construction market by revealing specific trends at regional and category levels.

The Pipeline data is based on projects reported on a daily basis in BCI’s real-time project lead database, LeadManager. For the past nine quarters all projects at Concept or Design & Documentation stage were extracted from the database by publishing date. Only new projects (projects reported for the first time) are included. The aggregate value of the projects is then established by quarter.

Overall Picture

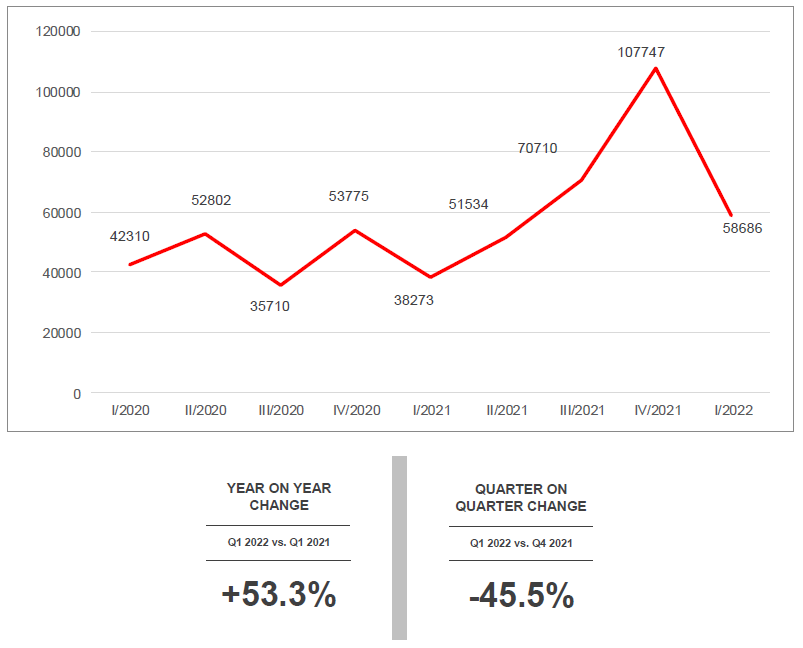

TOTAL CONCEPT & DESIGN STAGE PROJECTS IN AUSTRALIA (MILLION $)

Total early stage projects in Australia have reverted to a normative level following last quarter’s major replenishment. The civil-led surge in the previous period was mostly composed of utilities projects as well as a list of infrastructure developments.

Thank to our headline project, the Naval Base (PID 276497017) in QLD, the building segment is able to sustain average values and pull up the industry’s overall performance. Similarly, across states, QLD shows a strong and consistent trajectory.

Other states are on a downturn, except for the group composed of Tasmania, Northern Territories, and Other Territories in which we have reported the high-value Desert Bloom Hydrogen Project (PID 268394017), valued at approximately AU$15 billion, and the AU$2 billion Bass Strait Offshore Wind Energy Project (PID 268226017).

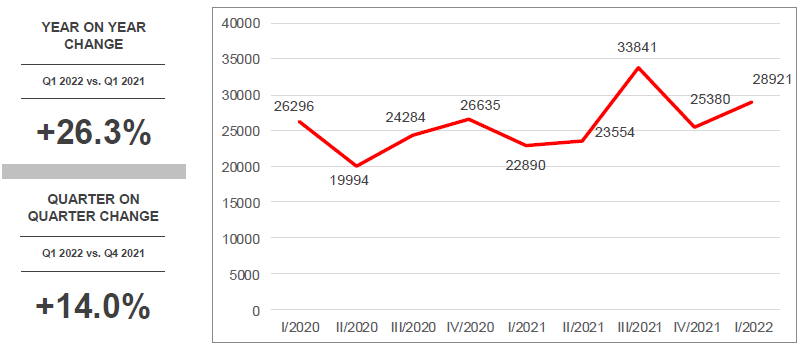

CONCEPT & DESIGN STAGE BUILDING CONSTRUCTION PROJECTS IN AUSTRALIA (MILLION $)

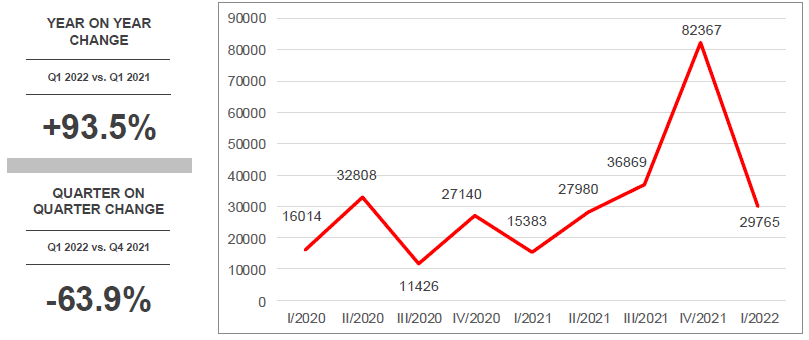

CONCEPT & DESIGN STAGE CIVIL CONSTRUCTION PROJECTS IN AUSTRALIA (MILLION $)

The downturn in civil early stage projects comes after an unprecedented surge brought on by utilities investments in the previous quarter. Back to a more usual level, the result for civil is within the long-term average without the Q4 2021 result. The billions of dollars allocated for infrastructure projects and the continuous shift to renewable energy ensure the continuous flow of activity in the sector.

For the quarter, civil early stage projects are sliding in most states, but some major projects are propping up the quarterly result. We note the AU$1.9 billion Melbourne Airport – 3rd Runway (PID 272736017), the Hyperone Project (PID 274601017) that is valued at approximately AU$1.5 billion, and from the utilities sector, the Wollongong Offshore Wind Project (PID 269239017), and the Hunter Coast Offshore Wind Project (PID 269232017).

To view more data for building (residential, community, education, office, industrial, retail and hospitality) and civil (infrastructure, transport, utilities) early stage projects, download the BCI Pipeline Report here.