- Rumah

- >

- Australia’s Construction Forecast: A Mixed Bag for Q4 2024

Australia’s Construction Forecast: A Mixed Bag for Q4 2024

BCI Forecaster is a monthly report that provides short- and long-term construction start forecasts, comparing the upcoming three months to the previous three and the current year’s 12-month period to the prior year’s, making it a valuable tool for short-term sales and operations planning.

The latest forecast for construction starts in Australia shows a mixed picture as the industry navigates short-term challenges and long-term growth potential.

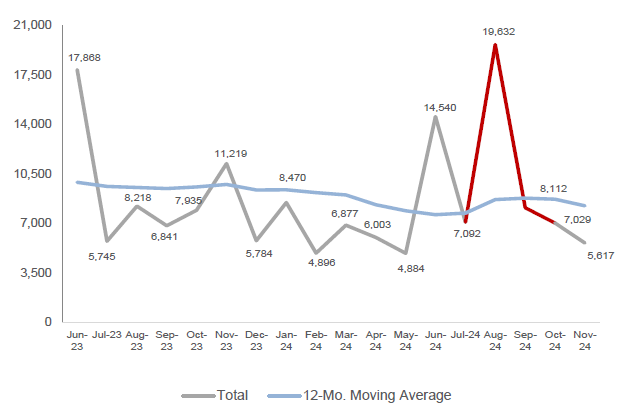

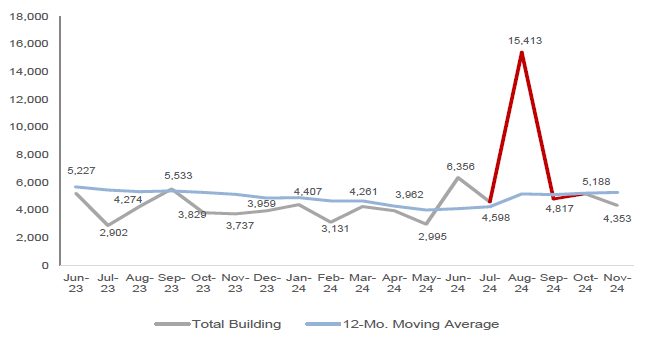

In the short term (September to November 2024), total building construction starts are projected to drop by 46% compared to the previous three months, largely due to a few high-value projects in previous months. However, the long-term trend still indicates a 3% rise, reflecting continued momentum in the building sector, which contributes over 70% of the total project value. Notable upcoming projects include the AU$330 million Eurobodalla Regional Hospital and the AU$415 million Market Square.

JUMLAH PEMBINAAN BERMULA DI AUSTRALIA (JUTA $)

JUMLAH PEMBINAAN BANGUNAN BERMULA DI AUSTRALIA (JUTA $)

Civil construction, on the other hand, paints a less optimistic picture with declines in both short-term (-57%) and long-term (-36%) starts. Major civil projects, such as the AU$800 million Outer Harbor LNG Project, are still in the pipeline, but no mega projects have surfaced during this period.

The retail and hospitality sectors shine with a 72% short-term surge, while sectors like office (-49%) and industrial (-86%) face significant contractions. Despite this, industrial construction shows promise in the long term with an impressive 86% growth.

BCI Central ANZ Research Manager Sarah Murphy highlighted the pressures facing the construction industry due to labor shortages and high inflation.

“This ongoing situation has led to a rise in insolvencies, but there are still major retail and hospitality projects ready to move forward, with modest long-term growth anticipated,” Murphy said.

“As remote work continues, we expect office construction to contract. However, if more companies require full-time office attendance, this could slightly alter the trend. Meanwhile, despite a short-term decline in residential building, demand is projected to outstrip supply, raising concerns about meeting the National Housing Accord targets.”

BCI Forecaster is powered by BCI Central’s real-time project lead service, LeadManager, which helps businesses track and manage opportunities efficiently, ensuring no critical events are missed.

As the market evolves, detailed insights and forecasts like these are invaluable for decision-makers. For a deeper dive into Australia’s construction landscape, BCI Forecaster offers detailed, real-time project data to help plan for the future.

Tekan di sini to find out more.