- Rumah

- >

- BCI Pipeline Report: Australia (Q2 2024)

BCI Pipeline Report: Australia (Q2 2024)

Information utilised in the BCI Pipeline Report Australia Q2 2024 is current as of 1 July 2024.

About the BCI Pipeline Report

Laporan Saluran Paip BCI menyediakan penunjuk utama suku tahunan bagi nilai projek pembinaan baharu pada peringkat awalnya (dari persaingan hingga dokumentasi). Ia merupakan sumber maklumat pembinaan yang penting untuk mana-mana organisasi atau individu yang berkaitan atau prihatin dengan masa depan industri pembinaan di Australia.

Laporan Saluran Paip BCI menawarkan lebih daripada sekadar pandangan umum pasaran pembinaan dengan mendedahkan arah aliran tertentu pada peringkat serantau dan kategori.

The Pipeline data is based on projects reported on a daily basis in BCI’s real-time project lead database, LeadManager. For the past nine quarters all projects at Concept or Design & Documentation stage were extracted from the database by publishing date. Only new projects in Australia (projects reported for the first time) are included. The aggregate value of the projects is then established by quarter.

Gambar Keseluruhan

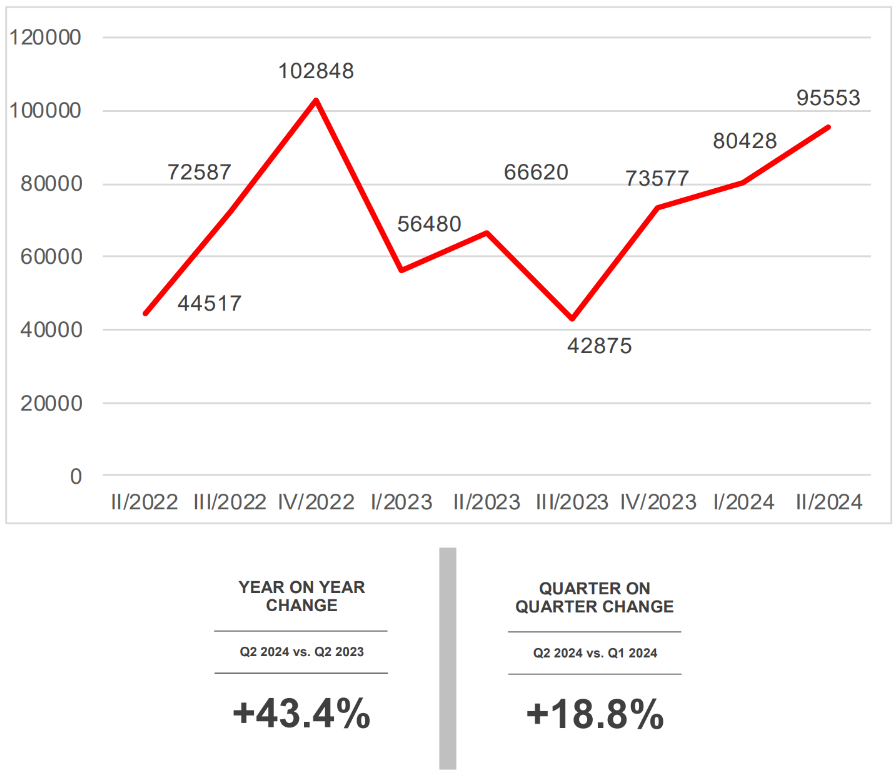

JUMLAH PROJEK PERINGKAT KONSEP & REKA BENTUK DI AUSTRALIA (JUTA $)

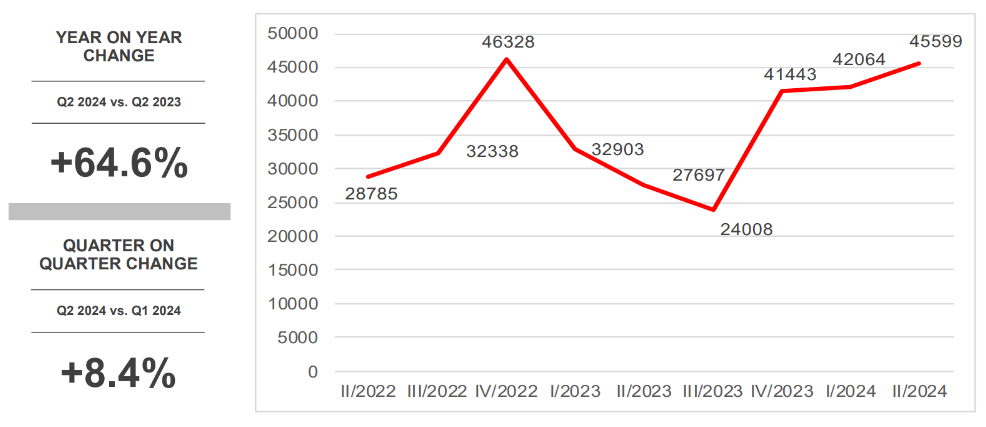

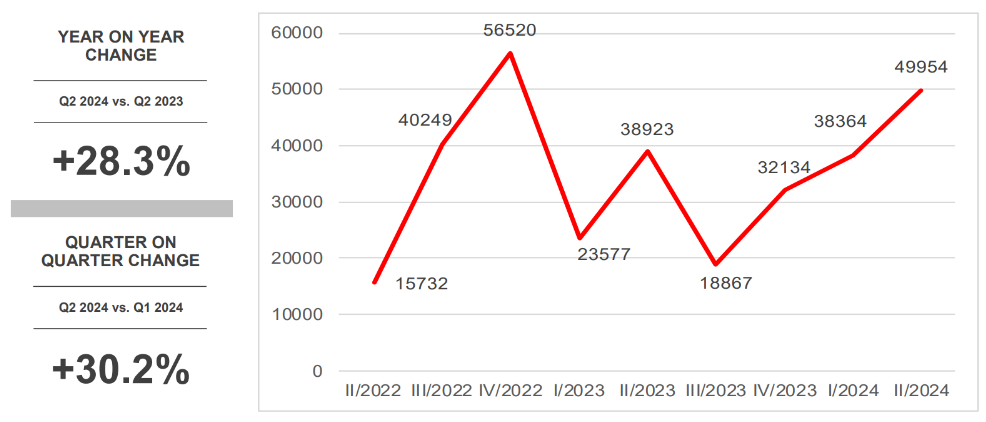

Despite the weak economic conditions, early-stage projects show robust results all around as both building and civil categories perform better than the previous periods in the short- and long-term comparisons. In this edition, the civil sector’s stellar climb is due largely to massive contributions from the utilities sector.

Looking at a state-by-state basis, NSW & ACT continue to dominate project proposals in terms of value, followed by QLD and then VIC. In contrast, VIC provides the greatest number of early-stage projects, followed by NSW & ACT. Interestingly, in terms of sector comparison, the community sector comes in second after the civil sector’s project number contribution.

PROJEK PEMBINAAN BANGUNAN PENTAS KONSEP & REKA BENTUK (JUTA $)

PROJEK PEMBINAAN AWAM PERINGKAT KONSEP & REKA BENTUK (JUTA $)

In this edition, civil project proposals contribute around 52% to the total of early-stage projects. Of this sum, the utilities sector is the leading source of new investments providing more than 90% to civil developments. Aside from our headline project from VIC, the AUS$10Bn Kut-Wut Brataualung Offshore Wind Farm (PID 347171017), a number of utilities projects are being lined up. Among the highest-valued projects are the AUS$4.5Bn Iberdrola – Aurora Green Offshore Wind Farm (PID 345921017) in VIC, the AUS$3Bn Western Sydney Pumped Hydro (PID 343520017) in NSW, and the AUS$3Bn Boomer Green Energy Hub (PID 342647017) in QLD.

Nevertheless, the infrastructure and transport sectors continue to lend support with projects such as the AUS$750Mn Camerons Lane Interchange (PID 349723017) in VIC, and the AUS$540Mn Trans-Australian Railway Line (PID 349743017) in WA.

Looking for more insights into new projects in Australia? Get in touch today to learn more about our BCI Pipeline Report Australia Q2 2024 and early-stage project data in the building (residential, community, education, office, industrial, retail, and hospitality) and civil (infrastructure, transport, utilities) sectors.