- 首頁

- >

- BCI Forecaster Report: Australia (July 2024 – September 2024)

BCI Forecaster Report: Australia (July 2024 – September 2024)

Information utilised in this Australian construction industry forecast report is current as of 1 July 2024.

About the BCI Forecaster

The BCI Forecaster is a leading monthly indicator of construction contract values hitting the market in the upcoming three months. Construction start values are presented Australia-wide, broken down by civil and building construction as well as by five key states and six key building sectors/project categories.

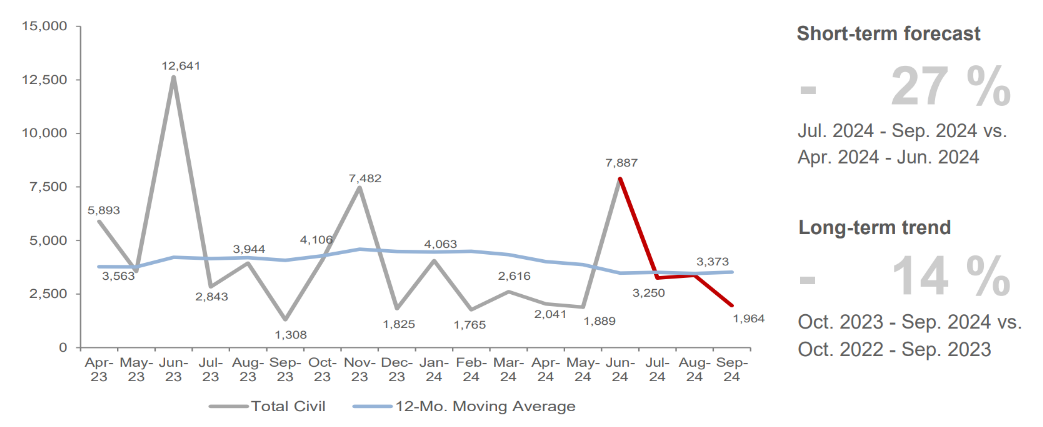

通過將近期三個月前景與前三個月進行對比來說明短期預測。將 12 個月的開工建設價值與一年前相應的 12 個月期間進行對比,可以看出長期趨勢。

BCI Forecaster 是不可或缺的短期規劃工具,可讓決策者為其銷售和運營團隊設定切合實際的目標和參數。

數據基於 BCI Central 的實時項目線索數據庫 LeadManager 每天報告的項目。

快照

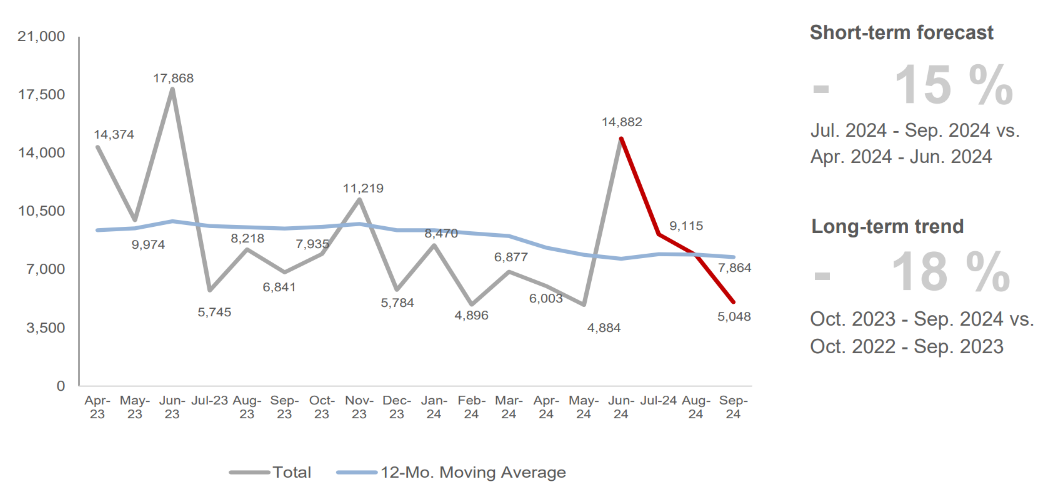

澳大利亞開工建設(百萬 $)

外表

According to the NAB monthly business survey released in June, business confidence deteriorated to -3 index points, which was a decline of 4 points in May 2024. The muted economic growth continues to cast a shadow in the economy. In particular, confidence weakened the most in manufacturing, transport, utilities and construction, including wholesale, recreation and personal services.

Meanwhile, the Australian Bureau of Statistics (ABS) released the May inflation rate at 4% which was higher than anticipated, ahead of market forecasts. According to the ABS, the areas with the biggest price increases were housing (5.2%), food and non-alcoholic beverage (3.3%), transportation (4.9%), and alcohol and tobacco (6.7%).

In this edition, total construction starts have declined from a monthly and annual comparison as the June peak overshadows the succeeding months’ performance. Despite this, the level of projects in the pipeline that are anticipating builder appointment is reassuring.

建築業

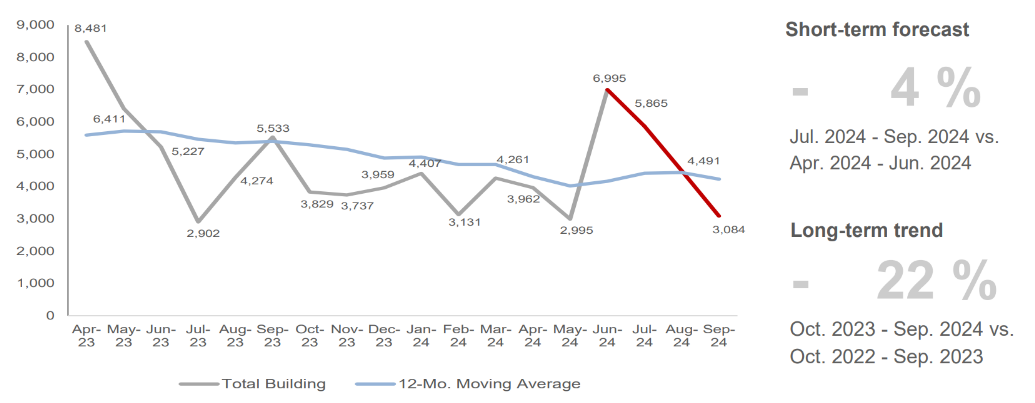

澳大利亞開工建設總建築(百萬 $)

Although there are encouraging signs of improvement in the residential sector from building permits as well as the level of commencements, the long-term view is still in recovery at a pace of 1%. Meanwhile, the non-residential building categories are fluctuating in the short term with the retail and hospitality, and office sectors exhibiting a robust result for the quarter with projects such as the AUS$974Mn Airtrunk SYD3 (PID 46847021) in NSW, which has started site works.

Notwithstanding, the industrial sector still records notable projects such as the AUS$500Mn Visy Glass Project Apollo (PID 46822021) in QLD. The community sector is also exhibiting noteworthy health projects such as the CEP – Cairns Hospital Expansion (PID 306725017) and the Northwest Health Care Stage 1 – Coomera Health Campus (PID 233197017) in QLD with a combined construction cost estimated at AUS$500Mn.

民用部門

澳大利亞開始全面土木建設(百萬 $)

Projects slated for June have towered over the construction activity for the next three months. This key influence triggers the sluggish reading this edition. That is not to say that there are no major projects this quarter as we report the AUS$1.4Bn M7-M12 Motorway Interchange (PID 331228017) in NSW from the infrastructure sector, and the AUS$800Mn Outer Harbor LNG Project (169426017) in SA from the transport sector. From the utilities sector, the Unitywater – Capital Works (PID 349949017) and the Greenbank Large Scale Battery Connection Project (PID 287091017) from QLD have an estimated AUS$900Mn value.

To view more data for building (residential, community, education, office, industrial, retail and hospitality) and civil (infrastructure, transport, utilities) construction projects, get in touch for a copy of our Australian construction industry forecast (July 2024 – September 2024).